Maximize Your Crypto Earnings with Crypto.com Earn: A Guide

Written on

Understanding Crypto.com Earn

Crypto.com Earn allows users to boost their crypto holdings with annual returns reaching up to 14%. However, one must ask: is there a hidden catch?

Research shows that most traders end up losing money. Achieving consistent success requires immense emotional discipline, which many novice traders lack. Often, they succumb to FOMO during price surges and panic sell later—this classic misstep results in buying high and selling low.

This is where the strategy of simply holding on to your crypto, often referred to as HODLing, has shown to be much more beneficial for most investors. In recent times, financial technology firms like Crypto.com, BlockFi, Celsius, and Nexo have made this approach even more appealing by offering regular interest on the cryptocurrencies stored in their platforms.

These platforms are commonly referred to as crypto interest accounts.

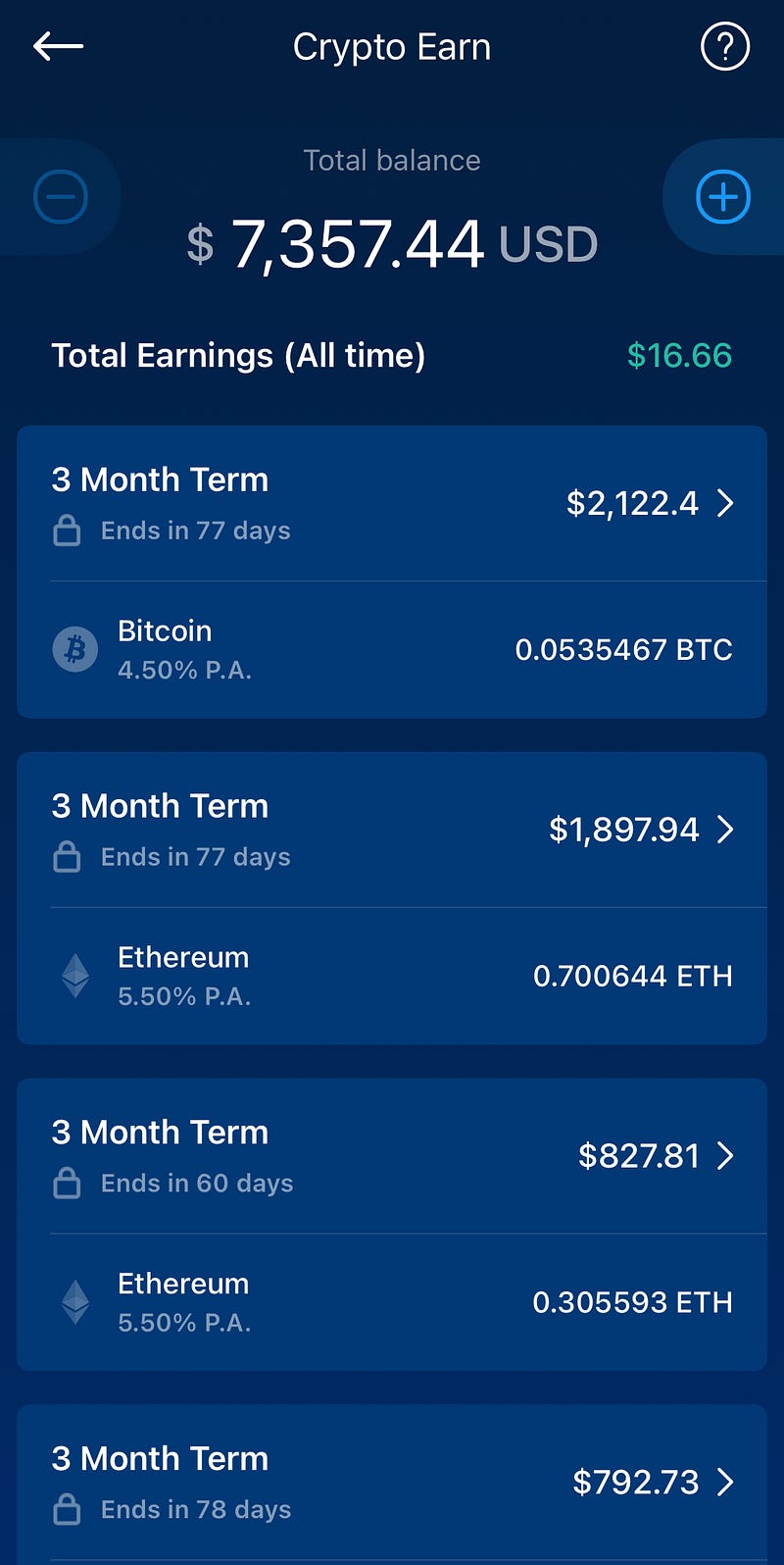

On Crypto.com, this service is termed Crypto Earn. Users can deposit their BTC into the Crypto.com Earn wallet and earn additional BTC at an annual rate that varies between 2% and 8.5%. To get started, you can sign up for Crypto.com using the referral code ‘col’ to receive $25 in CRO when applying for a Ruby Steel card or higher. This also grants you up to 8% cashback on daily purchases, along with perks like free Spotify, Netflix, Amazon Prime, and more.

In this article, we'll explore the following:

- A comparison of Crypto.com’s Earn product with its competitors

- An explanation of how interest rates are determined

- The interrelationship between the CRO token, Crypto Earn, and the Metal VISA cards offered by Crypto.com

- My personal strategy for utilizing Crypto.com effectively

Let’s dive deeper!

What is Crypto.com?

Crypto.com, a fintech based in Singapore, is often joked about for having one of the largest marketing budgets in the industry. Just look at their high-profile ad featuring Matt Damon, directed by Academy Award-winner Wally Pfister, and their expanding portfolio of naming rights deals—like the transformation of the LA Lakers’ Staples Center into Crypto.com Arena.

Beyond marketing, Crypto.com has established itself as one of the most credible cryptocurrency firms in the market, building an ecosystem that rivals Binance in its scope. Their offerings range from crypto buying, saving, lending, to metaverse, NFTs, and derivatives trading.

While other established fintech companies, such as BlockFi, Celsius, and Nexo, primarily focus on interest accounts, Crypto.com’s extensive ecosystem positions it as a comprehensive hub for investors.

Are Crypto.com’s interest accounts competitive? What are the reward rates for saving on the platform? And how does this relate to the CRO token and their well-known Metal VISA cards?

Crypto.com’s Earn Rewards Explained

Let’s start with Bitcoin (BTC).

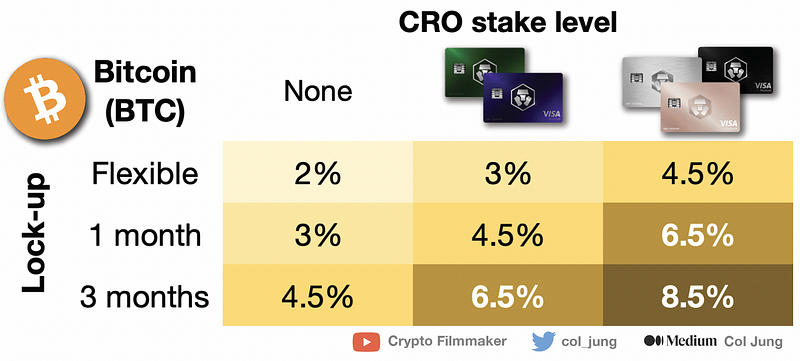

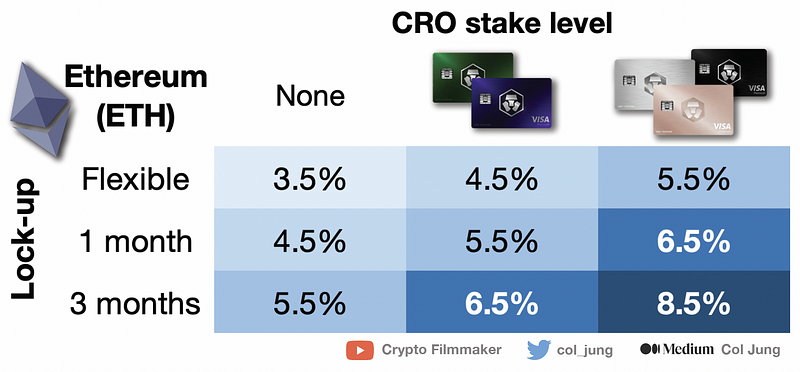

Crypto.com’s reward rates for BTC depend on two factors:

- Your chosen lock-up duration

- The amount of CRO you stake within the app

Unlike BlockFi, which provides a fixed annual return based on the amount of BTC held, Crypto.com’s rates fluctuate based on the aforementioned criteria. You can use their calculator to experiment with potential returns.

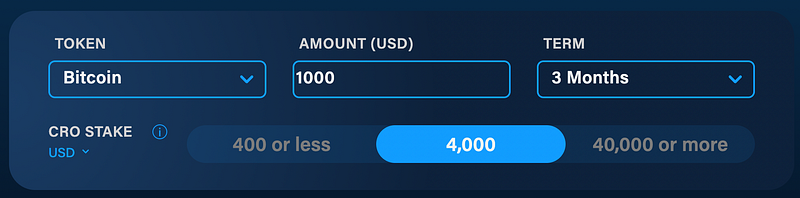

The requirement for CRO staking can be confusing. Is it 4,000 CRO tokens or $4,000 worth of CRO? The answer is the latter. If you stake $4,000 and the price drops, you are still secure as the snapshot is taken at the time of staking.

Understanding the CRO stake requirement helps clarify how it aligns with the eligibility for Crypto.com’s Metal VISA cards. For instance, to qualify for the Jade Green card, a stake of $4,000 in CRO is necessary.

The first video provides a comprehensive overview of the Crypto.com Earn Program, detailing everything you need to know about maximizing your earnings.

As you stake more CRO, you unlock higher reward rates for your crypto savings. For instance, if you stake enough CRO for a Jade Green or Royal Indigo card, you could earn a bonus interest rate on your entire Earn Wallet, receiving up to 6.5% on BTC and ETH, and 12% on USDC.

If you stake enough for a Frosted Rose Gold or Icy White card, the rates increase to 8.5% for BTC and ETH, and a remarkable 14% for USDC.

The second video serves as a full beginner's guide on making money with Crypto.com, discussing effective strategies and insights for new users.

In summary:

- Longer lock-up periods yield higher returns.

- The CRO token is central to the entire Crypto.com ecosystem, enhancing benefits across various products.

- Users who stake for a Jade Green/Royal Indigo card receive better interest rates for their crypto in the Earn wallet.

Next, let’s review the potential returns for other popular cryptocurrencies, starting with Ethereum.

The interest rates for Ethereum vary between 3.5% and 8.5%. Staking enough CRO ($4,000) for a Royal Indigo or Jade Green card grants you up to 6.5% on ETH, while a Frosted Rose Gold or Icy White card yields up to 8.5%.

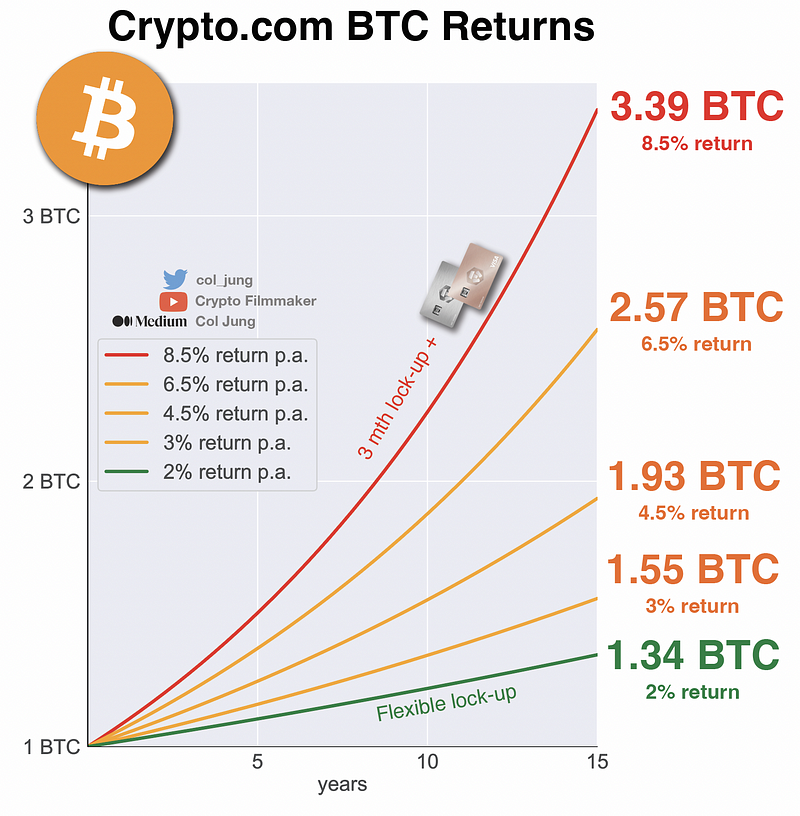

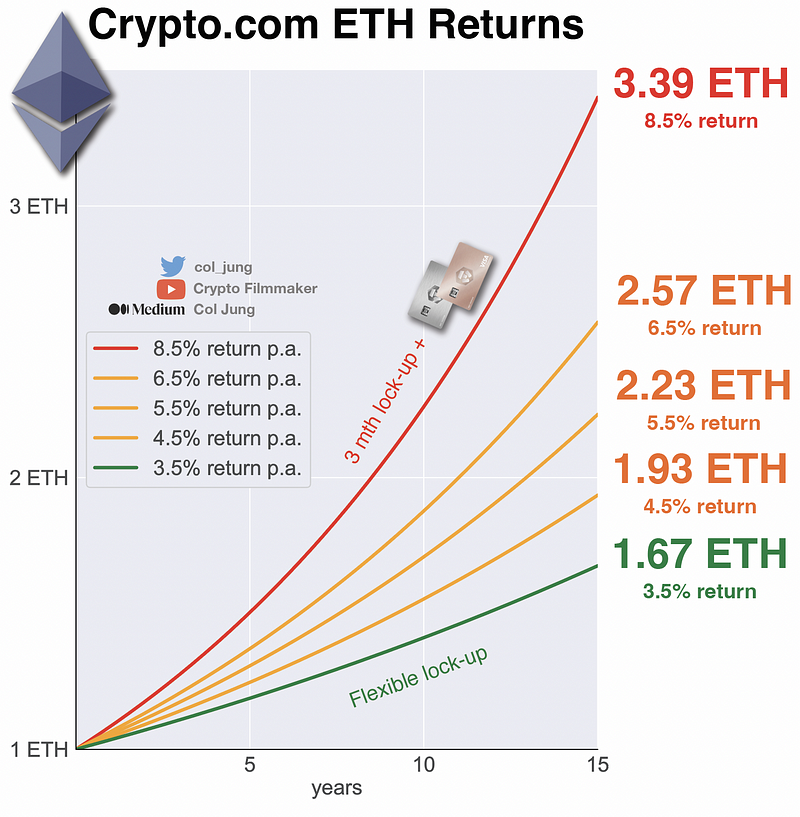

Here's a visual representation of the long-term impact of these varying rates due to the compounding effect.

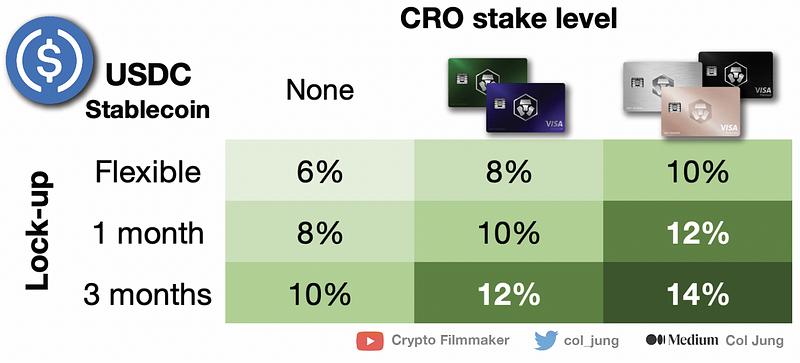

The highest rates are offered for stablecoins, with returns reaching up to 14% for those staking sufficient CRO ($40,000) for the Frosted Rose Gold or Icy White card.

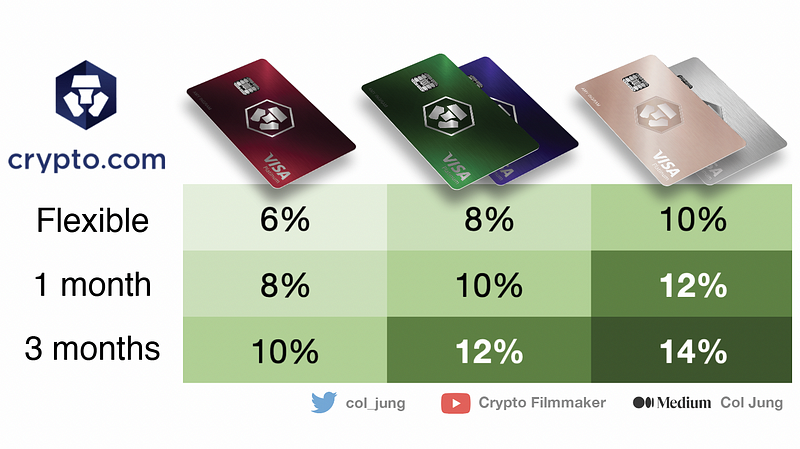

The following matrix outlines the interest rates for the USDC stablecoin:

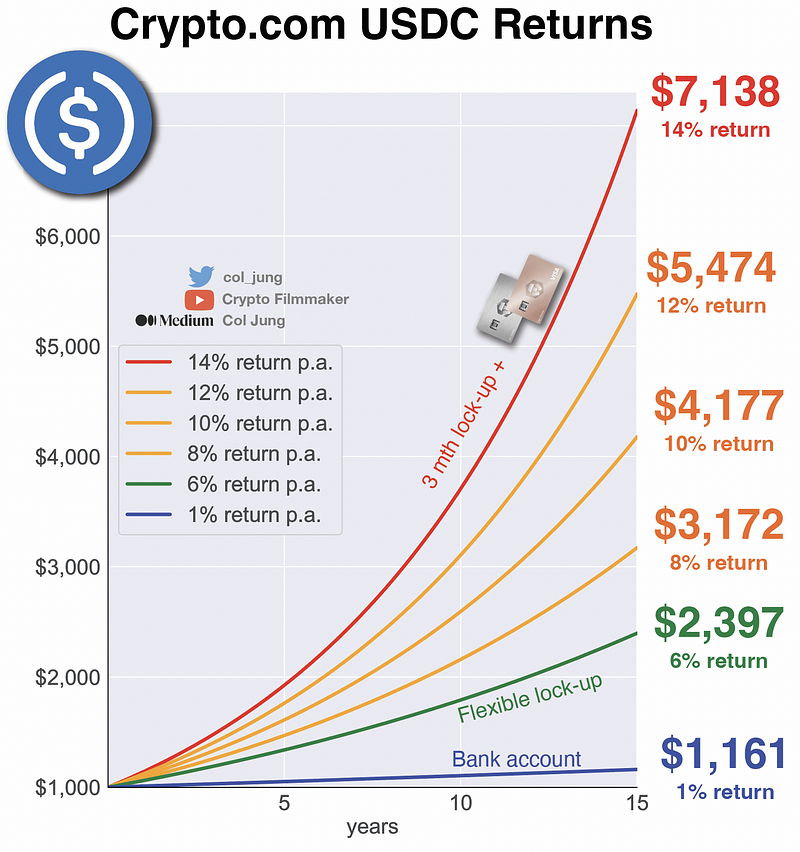

Investing in stablecoins is increasingly appealing to traditional investors who seek the stability of fiat currency while aiming for significantly better returns than what traditional savings accounts offer.

This is a substantial improvement compared to the meager 0.05% to 1% returns typical of bank deposits, even outpacing the average stock market returns of 9% to 11%.

There's much to ponder here.

So, what’s my personal take on Crypto.com Earn and its broader offerings?

My Strategy for Using Crypto.com Earn

The primary advantage of Crypto.com is that it serves as a reliable all-in-one platform for various crypto-related activities for most investors. Therefore, the more products you engage with on Crypto.com, the more benefits you reap.

For instance, users with a Jade Green or Royal Indigo VISA card enjoy attractive reward rates on their crypto savings—up to 6.5% annually on BTC and ETH, and 12% on USDC.

Even if you don’t qualify for any of their cards, you can still secure competitive rates by locking your funds for three months. This strategy is especially wise for those who might otherwise impulsively trade—remember, most traders lose money!

I personally view Crypto.com as a means for passive income through HODLing. I tend to purchase BTC and ETH during market dips and then deposit them into Earn with a three-month lock-up. This is part of my long-term investment strategy, while my short-term trades are managed on other platforms.

At the same time, I am consistently accumulating CRO to elevate my status for the next level of VISA card, which in turn will enhance my Earn reward rate!

It’s essential to consider custodial risks as well. Many investors are hesitant about allowing centralized firms like Crypto.com, BlockFi, Celsius, or Nexo to manage their crypto assets. Therefore, selecting trustworthy platforms is crucial before weighing the benefits of regular interest against the risks of not having self-custody.

Ultimately, it’s a choice each investor must make. If you’re eager to earn interest on your long-term crypto, consider diversifying across several reputable platforms. Personally, I utilize a combination of these companies to mitigate platform-related risks.

I hope you found this guide informative.

For ongoing insights and analyses, feel free to follow me on Twitter and YouTube.

My Crypto Articles

- Unlock unlimited access to Medium by joining here.

- When Will the Bear Market End? Macro 101 for Crypto Investors

- A Review of the Cryptocurrency Market in 2022

- Web3 Gaming — What do Crypto, NFTs & Metaverse offer?

- FTX’s Collapse & Solana’s Long-term Impact

- Polygon & Solana — 6 Killer Crypto/NFT Use Cases

- A Brief History of NFT Marketplaces

- Compound Interest is the 7th Wonder of the World

- How to Generate Passive Income with Crypto

- Crypto Passive Income on BNB Chain

- Move & Earn Crypto — 6 Month Review of STEPN

- PancakeSwap’s High APY Pools — What’s the Catch?

- Cardano, Avalanche, Solana Staking Guides (2022)

- Cardano, Avalanche, Solana Price Predictions (Bull Market)

- How to Make Crypto Price Predictions

- Top 3 Price Prediction Mistakes

- Crypto VISA Cards — Cashbacks for Every Purchase?

- How to Build Wealth like Smart Money

- Is Crypto.com’s Earn Program Worth It?

- Understanding Terra’s Anchor Protocol

- How to Participate in Initial DEX Offerings

- Memecoin Speculation — Is It Worth It?

- Why SHIB Can Never Reach $1 (or even close)

- Want to Retire Early? Buy Bitcoin

- Democrats vs Republicans — Which Party Better for Markets?

- Crypto Sign Up Bonuses

- Binance — 5% off fees forever (link)

- Nexo — $25 free BTC with $100 deposit (link)

- Crypto.com — $25 free CRO with a Jade Green VISA Card (link)