Understanding the Unviable Nature of Crypto Arbitrage in MLM

Written on

Chapter 1: The Background of Crypto Arbitrage

To kick things off, let's revisit a significant news event: Santiago Fuentes, the CEO of Arbistar, was arrested in Tenerife facing multiple charges, including fraud and money laundering. This incident has sparked widespread skepticism around numerous businesses, with many labeling them scams. When asked for their reasoning, the responses often lack substance, typically stating, “It’s a scam simply because it seems like one and lacks sustainability.”

I liken myself to a truffle dog when it comes to sniffing out scams. However, I refrain from labeling something a scam unless I have conducted thorough due diligence. So, how do I identify a scam?

Section 1.1: Key Questions to Consider

When someone presents a business opportunity to me, my first step is to investigate the motives behind their suggestion:

- What incentives do they have for promoting this business?

- Is the investment level reasonable?

- What asset underpins the projected returns?

- Are they earning a commission from my involvement, or are they simply being altruistic? If they do earn a commission, how is that funded? Is my initial investment being divided among various income streams within the MLM structure?

- How many individuals can join this business model? Is the entry point as low as $100, or does it require several thousand euros? How many people are they targeting?

- Some businesses may indeed be profitable, but how scalable are they?

Let’s illustrate this with a simple example of Arbitrage.

Subsection 1.1.1: The Fundamentals of Arbitrage

Crypto Arbitrage has its roots in the mid-20th century stock exchanges. The concept is straightforward: purchase an asset on one exchange where it's priced lower and sell it on another where it's higher.

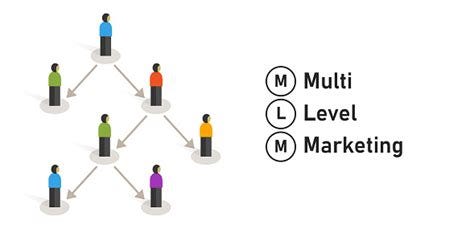

Throughout the years, various Multi-Level Marketing (MLM) schemes have attempted to capitalize on Arbitrage, but typically, only the scheme's creators profit—through network commissions or the sale of automated or semi-automated Arbitrage software.

For instance, if uplines and founders benefit from my initial investment package, my capital is effectively split. Suppose I invest $100, and $15 is directed to the uplines; this leaves me with only $85 at work.

Let’s break down the math: $15 from $100 represents a 15% commission. To recoup my investment, I need to generate a profit of 17.6% on the remaining $85. This is slightly higher than the 15% commission, indicating that the more substantial the network commissions taken from the initial investment, the less sustainable the business model will be.

If the focus shifts to selling software licenses, the core issue remains. How many licenses are required to saturate the market? Once saturation occurs, can the business continue to thrive?

For Crypto Arbitrage software, the more individuals using the same software, the lesser the profitability for everyone involved. If you're considering a software license, ensure it's not so widely accessible that it leads to market saturation, or you risk entering a losing proposition.

Section 1.2: Exceptions to the Rule

Not all software license schemes are unsustainable. For example, if a company offers email management software, the market may take longer to saturate. Even if residual profits from affiliations dwindle, you can still benefit from the software's features and potential residual incomes from subscriptions.

Chapter 2: The Sustainability Challenge of Crypto Arbitrage

So, why is Crypto Arbitrage unsustainable in an MLM context?

Arbitrage opportunities are fleeting. For a practical example, let's examine the Bitcoin/Dollar market:

Exchange 1:

- Buy Price: $1000

- Sell Price: $1001

Exchange 2:

- Buy Price: $990

- Sell Price: $995

In this scenario, you would buy BTC from Exchange 2 at $990 and aim to sell it on Exchange 1 for a profit of about 1%, minus trading fees. However, if multiple individuals are using the same Arbitrage software, the buying prices will quickly converge. For example, if another trader purchases at $991, and subsequent traders at even higher prices, the opportunities for profit diminish.

So, while you may be engaging in Arbitrage, if you are involved in an MLM promoting it, I recommend saving your funds for more worthwhile endeavors, like donating to environmental causes or helping those in need. Such contributions are likely to yield a more positive impact than an MLM Arbitrage scheme.

New to trading? Consider exploring crypto trading bots or copy trading for a more sustainable approach.