How Much Money You Should Save by Age for a Secure Retirement

Written on

Chapter 1: Understanding Financial Freedom

In today's world, many individuals aspire to attain financial independence. The dream of retiring without financial worries and pursuing passions without monetary constraints is a common goal. However, achieving this requires a strategic savings plan tailored to each life stage.

Many people might not have started saving at 18, which is understandable given the various priorities at that age. Fortunately, it is possible to catch up later by saving a little more. Some individuals may even find themselves ahead of the curve and on track for early retirement. Yet, for many, uncertainty looms over whether they are on the right savings path.

So, how can you determine if your savings strategy is effective? This article outlines the amounts you should aim to save by age to retire as a millionaire, enabling you to make informed decisions about your financial future.

Section 1.1: Retirement Savings Goals

To illustrate the necessary savings to reach one million dollars, I will assume a 5% annual return on investments. While some may require more, others can retire comfortably with less if their major expenses, like housing and vehicles, are already settled. Adjust the values I present to fit your personal situation.

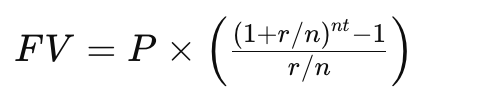

The calculation of future savings can be simplified using the future value of a series formula:

- FV = Future Value of the series

- P = Monthly payment (savings each month; I’ll use an average of $650)

- r = Annual interest rate (5% or 0.05)

- n = Compounding periods per year (12 for monthly)

- t = Total years until retirement

This formula helps determine the optimal amount to save for financial independence by a certain age.

Section 1.2: The Path to a Million

To achieve a million dollars by your 60s, you should aim to save about $600 each month. Starting early makes it easier, but it’s not impossible to reach this goal if you begin later. Many people worry about not having a specific amount saved by a certain age, but catching up is always a possibility.

It's crucial to recognize that financial goals can be met at any age. Although saving earlier may lessen monthly contributions, it's entirely feasible to become a millionaire later in life, regardless of when you begin saving.

Chapter 2: Practical Tips for Saving

This first video, "EXPERTS | How Much Should You Have Saved At EVERY Age," discusses the savings milestones you should hit throughout your life. It provides insights into how to catch up if you're behind and encourages a proactive approach to saving.

The second video, "How much money you should save BY AGE?" dives deeper into age-specific savings strategies and offers practical advice for planning your financial future.

As I reflect on my own experiences, I realize that saving becomes more manageable with time. Early financial advice often emphasizes saving specific amounts from a young age, which can be unrealistic for those with other pressing financial responsibilities.

For example, during my early 20s, my focus was on tuition and transportation costs, making it challenging to save. Now, with fewer commitments, I find it easier to catch up on my savings goals.

If you find yourself falling short of the recommended savings by a certain age, assess your current financial situation. Determine how much you need to save to reach your target and set a realistic timeline to achieve it.

Consider ways to enhance your income or investment returns, perhaps by seeking higher interest rates or alternative income streams. The key is to find a balance that allows you to save without drastically altering your lifestyle.

Ultimately, there is no universally perfect retirement amount. Individual needs vary, and it's essential to set personal benchmarks rather than rigidly adhering to generic advice. Understanding this can alleviate the pressure many feel about their financial progress.

What about you? Are you on track or needing to catch up? Stay informed by subscribing to my email list to receive more insights and tips on achieving financial freedom.